Company Profile

Approvals are just as quick, with most borrowers getting an answer in as little as 90 seconds. The funds can be with you in just 24 hours. You can apply for a loan through 5Kfunds if you have bad credit or no credit rating at all. A range of interest rates and repayment terms are on offer so you’ve got a lot of flexible choices.5Kfunds currently sits with an F rating with the Better Business Bureau, and it doesn’t hold accreditation. Negative reports tend to focus on unsatisfactory answers given to customer queries, and complaints about fee refunds where loans are declined.

As with taking out any loan, we’d recommend caution before signing any documents. Do your research into individual lenders too. Just because 5Kfunds offers quick service, it doesn’t mean you have to rush into a decision.

Loans and policies breakdown

5Kfunds only provides one type of personal loan option. It’s not a comparison site for other types of borrowing, like student loans or mortgages. You’ll fill in just one form and 5Kfunds will try to match you with the providers it thinks you’re most likely to be approved for a loan with. This means every option you’re presented with counts as being pre-qualified.

You then choose which lenders you’d like to be contacted by and they’ll get in touch as soon as possible. However, at this stage, your credit history may be subject to hard pulls, which could have a detrimental effect on your credit score if you click through to too many lenders.

The loan features include:

Borrow between $1,000 and $35,000

Interest rates between 5.99% and 35.99%

Repayment terms between 60 days and 6 years

Some lenders charge origination fees, late payment charges, and early repayment charges

The loan offers are upfront and transparent

All fees, charges and interest rates will be made clear before applying

Key advantages of 5Kfunds

Getting your hands on money quickly is the biggest advantage of using 5Kfunds. There are no loan restrictions on the money you borrow, so there’s a good chance you can have the money in your account quickly.

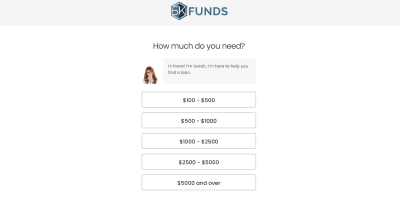

Also, the application process is one of the simplest we’ve seen. A short application form is available right at the top of the 5Kfunds homepage. Just fill in five pieces of basic, personal information and you can have your application done in just a few minutes.

Key disadvantages of 5Kfunds

Customer support is somewhat lacking at 5Kfunds. Contact information is a little difficult to find via the website and there’s no phone number to call. It’s been known for customers to not receive responses via email, and the email address doesn’t seem to be working all the time. In addition, 5Kfunds won’t resolve any issues you have with your lender. Once you accept the loan you’re responsible for contacting the provider directly.

Limited information on lenders is available via the website. You’ll have to make an initial application before you’ll be given any idea of rates or terms. This makes it more difficult to conduct your own research on lenders and risks a number of hard pulls to your credit history.

Summary

5Kfunds is ideal for those looking for quick money who want a wide range of flexible options to choose from. Whether you have an excellent credit history or no credit history at all, we’d recommend putting in an application. There’s an incredibly high chance of being accepted by at least one of the hundreds of lenders, and you may get quite a favorable interest rate if you have a good credit history.

However, be aware of some of the reported customer service issues, and do proceed with caution. There are risks when taking out any loan, so do as much research as you can on your chosen lender before signing up, and make sure you understand the finer details of the contract.