It offers loan options to those who have bad credit or have been rejected for loans elsewhere. LoansUnder36 states that all types of credit history are accepted in applications, but this doesn’t guarantee you’ll be able to get a loan. The decision to lend will ultimately sit with the partner lender. However, with such a large number of lenders available to choose from your chance are good.

There are a few points to look out for when using LoansUnder36. It asks for a few more personal details than other borrowing comparison sites including driver’s license and social security details. So if you’re not comfortable with a lot of your personal data being shared with potentially dozens of lenders, you may want to choose a different service.

Also, LoansUnder36 doesn’t guarantee no hard pulls will be made to your credit score when comparing, which could adversely affect your score in the long run.

Loans and policies breakdown

LoansUnder36 keeps things very simple. All the personal loans are accessed through one, easy-to-use application form. With so many lenders to choose from you’ll have access to one of the widest selections of rate and repayment options out there.

The key features include:

Borrow between $500 and $35,000

Interest rates between 5.99% and 35.99%

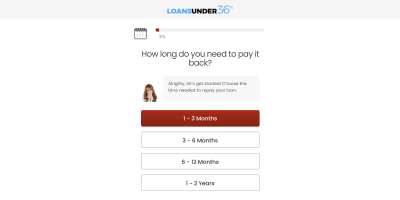

Repayment periods between 60 days and 6 years

You have the option to make payments once or twice per month

Decisions may be made in as little as two minutes, and the money could be in your account the next day

You should understand that given the large number of partner lenders, not only will you see a big variance in the interest rates and repayment terms, but you can also expect this in the number of charges you might have to pay. You’ll need to take care to understand the terms of each loan carefully before signing up. It pays to do your own research into your chosen lender too.

Key advantages of LoansUnder36

LoansUnder36 is a perfect choice for you if you have bad credit or no credit. However, this doesn’t mean it’s not worth applying if you have good credit. In fact, if you have a strong credit rating, there’s a very good chance you’ll be able to pick up a loan with a great interest rate and flexible repayment terms.

LoansUnder36 is one of the easiest loan comparison platforms to use. All information is presented on a one-page website, and all you need to do is type in the amount you’d like to borrow to start the process off.

Key disadvantages of LoansUnder36

Unfortunately, LoansUnder36 doesn’t offer other different types of loans. While other comparison sites allow you to compare student loan rates, consolidate your debt, look for mortgages, search for credit cards and refinance, LoansUnder36 only offers basic personal loans. If you’re looking for other loans and financial services, you’ll have to look elsewhere.

Unfortunately, LoansUnder36 collects a lot of personal data from you. It promises not to share this without your consent. However, you should still be careful when agreeing to terms if you don’t want your data going out to a lot of different lenders.

LoansUnder36 requires you to sign a waiver promising not to sue any lender you sign up to. While it’s highly unlikely you’ll ever need to go this far with a lender, it’s something you should be aware of should you run into any significant dispute with your lender down the road.

Summary

If you’re looking for fast, flexible loan options, then LoansUnder36 is an excellent place to start. Given the large number of partner lenders, there’s a very good chance of being accepted for a loan. With no real significant downsides, we would recommend considering the usual risks you would with any loan. Make sure you read the fine print, understand extra charges and make sure you’re able to keep up with the repayments.